There is something terribly wrong with material suppliers lately – most notably steel mills. Nucor Corp., the largest U.S. steelmaker, raised prices for a fifth time since late October. To be clear, this means steel prices have risen by over 55% in a period of just a few weeks, with no explanation whatsoever.

The last time prices of the metal have risen this fast was after steel tariffs were imposed by President Donald Trump in March 2018, with no formal announcements made by steel mills…

Industry Week, Jan 9, 2020

So what’s going on, and why are we seeing this trend? Well, first of all consumer goods made from metals have been way down due to the pandemic. For example, here’s what happened to Car sales.

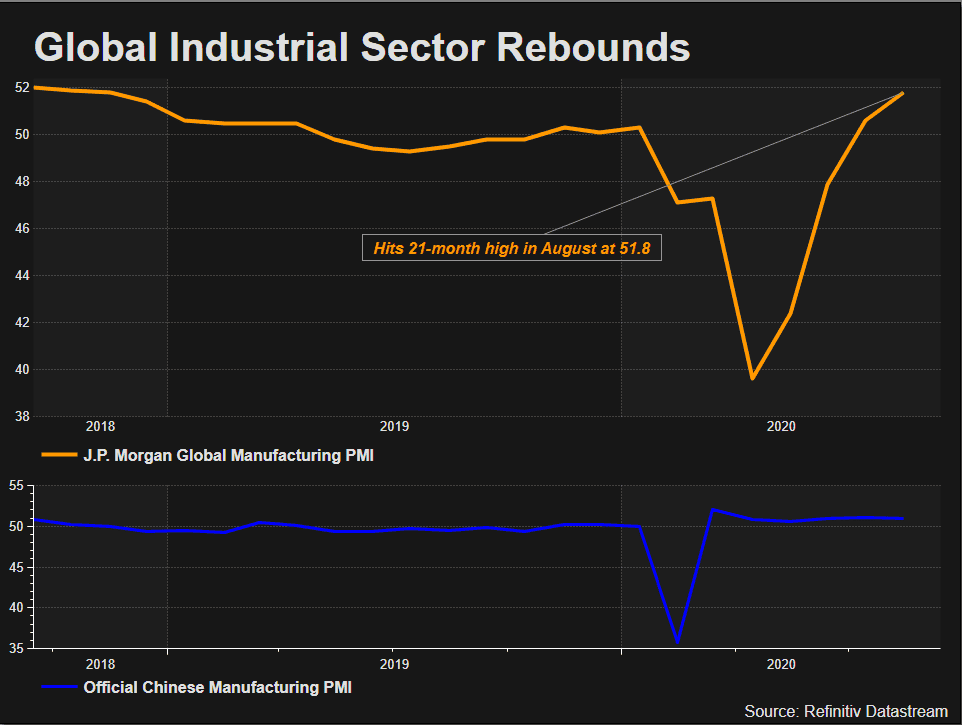

As a result of steep decline in demand, global manufacturing declined precipitously.

So steel factories shut down. And they are only just beginning to come back online as demand begins to return.

History of the Problem

Here’s a very brief timeline of the last few months since prices started increasing in the industry right now:

- First, back in September 2020 MetalMiner referenced a report that there was a supply problem with Iron Ore, but that producers were going to be increasing production.

- In September Bloomberg also reported, “Supplies remain tight, mostly because steel-plant usage has been running near multi-year lows as Covid-19 pandemic lockdowns sapped demand for areas including construction, automobiles and appliances.”

- By November, prices continued to increase as ,”Many service centers, which have been working through steel inventories for much of the year, have made large buys in recent weeks…”

- By December, metal indices rallied on news that prices would yet again be increasing. And that, “In another report, brokerage Motilal Oswal said that domestic hikes are being supported by higher regional prices, which in turn are being driven by a sharp rise in Chinese domestic steel prices.”

- In December it was also reported that, “… contrary to rising steel prices, the raw material basket has been a mixed one. While iron ore prices are at a multi-year high, coking coal prices are at a four-year low, noted the report.”

- By January, Nucor announced their 5th price increase due to “…extending lead times and strong order placement.” And of course, “The move will be broadly supported by peers.”

Industry Insiders Are Concerned

I think one particular quote from an article in The Fabricator sums it up nicely:

“I’m not used to such a combative relationship. The darn mills are taking an odd stance. They are telling us to take it or leave it. There are other places to purchase steel. The mills never learn their lesson,” said one manufacturing executive.

The Fabricator – Dec1, 2020

We routinely purchase steel by the 10’s of thousands of pounds, and I’ve spoken with 4 different suppliers over the last few weeks who all expressed concern about both the supply and pricing of inbound materials. In fact, some of the materials we use to build things like our Welding Tables are so hard to get that most suppliers literally can’t get any for us at the moment! Those who can provide price quotes that are only good for 24 hours!

This would lead one to believe that the steel producers are being greedy and hoarding all the profits at the expense of everyone else. But that’s not the case.

Despite the revival in steel prices, company margins are still suffering due to high costs, especially of iron ore. Spot prices of the raw material SH-CCN-IRNOR62 are hovering at the highest levels since January 2014.

Reuters – Sep 2020

When Is It Going To End

This is the big question! But given that raw material costs have increased, steel producers are only just recovering to their normal margins, factories are just coming back online, and there in increased demand globally, I wouldn’t expect to see cheaper prices any time soon. If we’re lucky, maybe by the second half of 2021 prices will come back down a little if supply can keep up with the demand. But we can’t count on it.

According to Seeking Alpha, “…steel has appreciated from $460 per metric ton in April to the $980 level at the end of December. The bullish trend looks set to continue in 2021.”

The US Midwest Steel price has already risen above the 2011 and 2018 highs. A falling US dollar, low interest rates, and the tidal wave of central bank liquidity, and government stimulus have planted the inflationary seeds of the future.

Add to that the fact that other global suppliers are predicting no end in sight, and you’ve kind of got your answer.

One Last Thought

After Trump’s 2018 tariff war we saw prices skyrocket by about 50% as domestic suppliers took advantage of the price differential without actually increasing their own capacity at all! And once the tariffs were removed, although the pricing came back down a bit, it never returned to the previous levels.

So it seems that once material prices go up, they basically stay up and it becomes the new “normal”.

The good news for products like ours is that as prices increase for materials and cost of production over time, it means the resale value of our products holds steady or even increase! For example, if you purchased a $2,000 welding table a year ago, and the current price of a new one is $2,500, you can likely sell yours for whatever you paid for it, if not more!

Having said that, if prices do come back down, we’ll readjust our prices as well because we want to stay in that sweet spot where high demand and fair margins intersect!